Serasa (Centralization of Bank Services) is a Brazilian private company in charge of analyzing data, conducting research and bringing surveys on the financial situation of both individuals and companies.

Through its database, it is possible to find out if a person or company is having problems with overdue or unpaid debts, protests and open titles, problem with returning bad checks and etc.

see more

Financial education is the best ‘medicine’ for chronic indebtedness…

Dirty name is not a problem: get to know the ‘Nu Limite Garantio’…

Generally, this default information is passed on by stores, banks and finance companies with the aim of strengthening and supporting the business market.

Daily, it is estimated that a total of almost 6 million queries are made on the Serasa. This search serves as a thermometer for the approval and release of credit, encouraging greater financial control.

Some important tips for those who want to stay with the “clean name” with Serasa:

1.Check your CPF status: in many cases, the person who is negative is unaware of their debt situation.

Therefore, the first step is to check your CPF status on the Serasa Consumer. PThrough it, you find out about any pending issues that are leaving you out of credit offers and analyzes from financial institutions.

2.Serasa Limpa Name: after discovering the debt amount and to whom the debt is owed, the user must proceed to the website Serasa Clean Name, created to function as a debt conciliator between creditor and debtor.

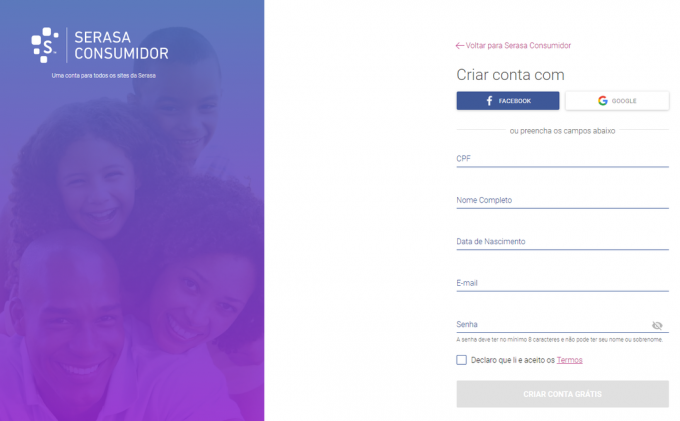

When accessing, the user must fill in the registration data and create a password. If you already have it, just enter the information from “Login" for access.

3. Debt renegotiation: done the "Login", the next step is to choose the best debt renegotiation option, especially one that fits into the budget and avoids further delays.

the function of “clear name” from the Serasa partners with several companies and financial institutions, further facilitating the chances of an agreement between the parties.

If you have managed to get a good proposal, the user should proceed to the negotiation step by step, which varies according to the company.

At the end, a payment slip is generated. Payment confirmation deadline is made within 5 business days.

After this period, the customer has his name removed from list of negatives. It is worth mentioning that the creditor company must also present a receipt stating that the amount has been paid.

It is important to remember that after 5 years the debt is no longer included in Serasa's database. However, that doesn't mean it ceases to exist. Companies, banks, finance companies, etc., can still charge and veto the release of credit to the customer.

See too: How to protest a check?