What is Darf? O darf refers to Federal Revenue Collection Document.

Issued by Ministry of Finance It is Internal Revenue Service, it is the collection of taxes made by the administrative bodies mentioned above.

see more

Financial education is the best ‘medicine’ for chronic indebtedness…

Dirty name is not a problem: get to know the ‘Nu Limite Garantio’…

When declaring the income tax, the taxpayer generates a bill that can either be paid at banks, lottery shops, ATMs or even be debited directly from the current account. However, this only applies to payments made before the due date.

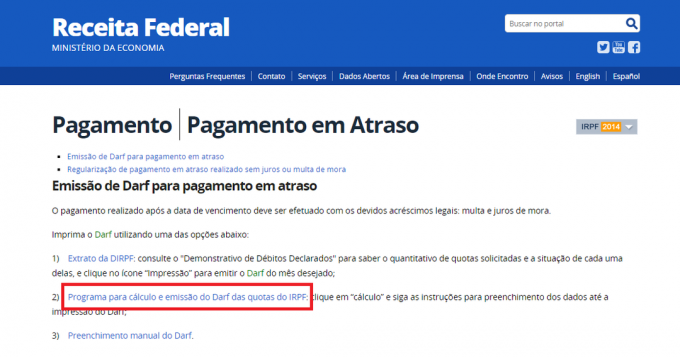

In case you missed the period, it is necessary to generate other guides of the darf, only this time with traffic ticket It is fees.

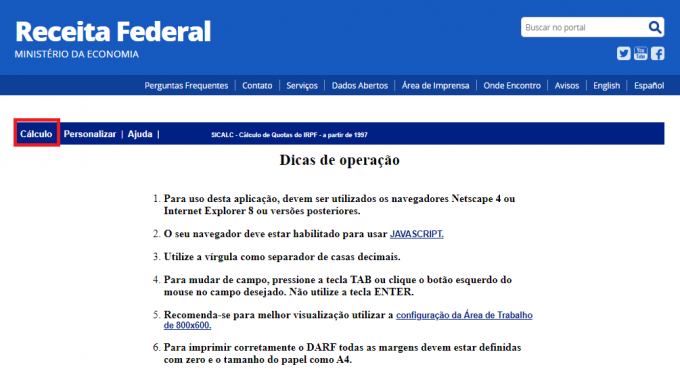

Check below how issue and calculate the fine of one Darf overdue.

If you missed the day to pay taxes related to Darf and don't know what to do? Follow our step by step and end this headache once and for all.

Attention: After generating a new invoice, it is imperative that the payment of the bill is made by the required date. Otherwise, it will be necessary to generate another delay guide and consequently a new calculation of the fine.

Before starting to calculate the amounts of the late charge, it is necessary to check the due date of the document, since it is from there that the operations will be carried out.

The default interest is calculated as follows:

To perform the calculation, it is necessary to add the total number of days from the due date to the probable payment date and apply the percentage. In cases where the value exceeds 20%, the limit set by the Federal Revenue Service is valid.

In relation to the legal addition, default interest on the value of the document is included, the calculation being made as follows:

If the delay is only one month, there is no late interest charge. That is, if the Darf expired on October 10th and the taxpayer makes the payment on the 27th of the same month, only the fine will be charged, but not the interest.

See too: Find out how to generate a late Income Tax slip